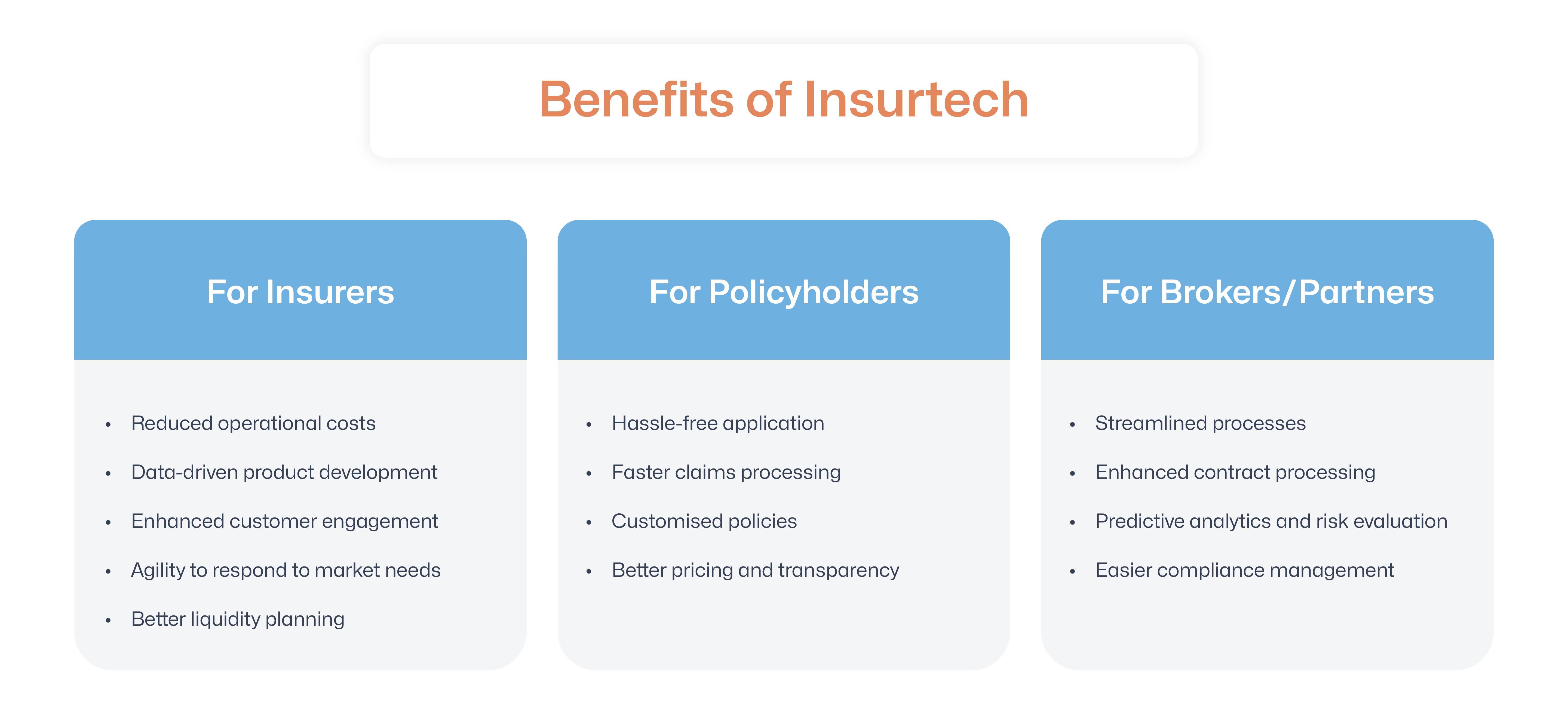

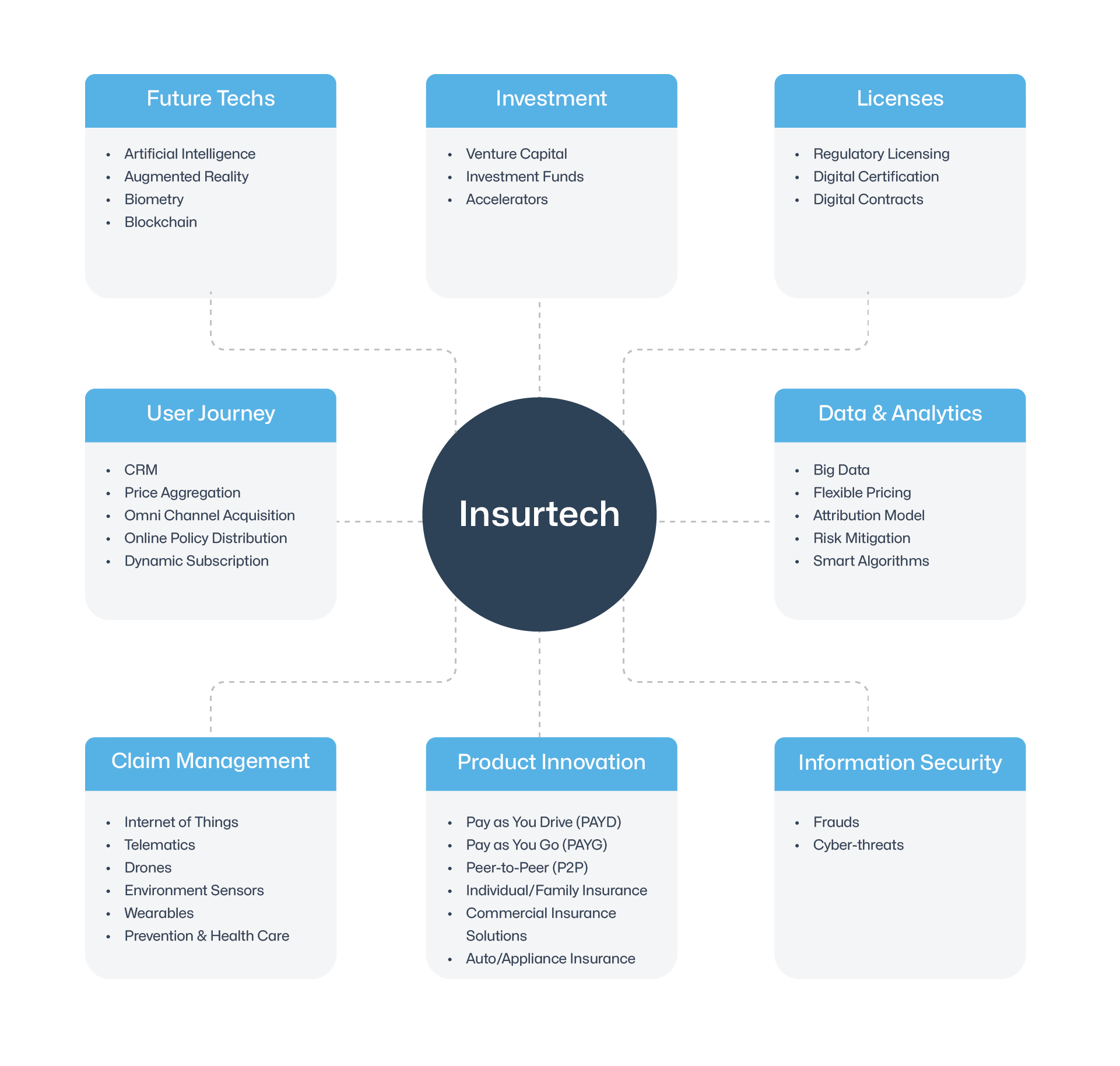

The simplest meaning of insurtech is an infusion of technology within insurance processes to create a more efficient and customer-centric industry. Insurtech companies harness innovation to deliver tangible benefits to insurers, brokers and policyholders.

What is Insurtech?

Insurtech is the practice of employing technology innovation to make the insurance industry more efficient, accessible, customer-centric and risk-aware, facilitating growth.

Short for insurance technologies, insurtech comprises digital tools and techniques that empower insurers to make informed decisions to drive customer satisfaction while lowering costs, enhancing security and minimising delays.

Why is Insurtech Important

Insurtech improves risk assessment accuracy, instilling flexibility and agility in insurers. Insurance technology revolutionises traditional insurance processes by:

Expediting application, underwriting, approvals, claims management and reconciliation.

Enabling personalisation of policies, premiums and payment mechanisms, leveraging analytics.

Lowering the cost of customer acquisition, personnel, policy distribution, customer support and claims evaluation.

Improving the accuracy of risk evaluation and fraud detection.

Facilitating business growth by enabling distribution through multi-channel and embedded modes.

Role of Insurtech Solutions in the Insurance Industry

Product Development

Identifies emerging risks, such as those due to proliferating cyber threats.

Uncovers opportunities from diverse sources, such as insurance groups on social networks.

Discovers usage-based insurance opportunities using telematics, wearables, robotics and other IoT devices.

Underwriting

Leverages AI to improve risk assessment and liquidity planning.

Employs predictive and prescriptive underwriting techniques.

Gathers insights from big data analytics to gauge emerging risk drivers.

Marketing

Increases the frequency and ease of customer interaction.

Enables insurers to position themselves as customer-centric.

Enables micro-market segmentation to create targeted sales funnels.

Distribution

Leverages smart devices and digital platforms for multi-channel distribution.

Improves the scope and efficiency of offline customer engagement channels.

Embeds insurance products into third-party channels to facilitate seamless distribution.

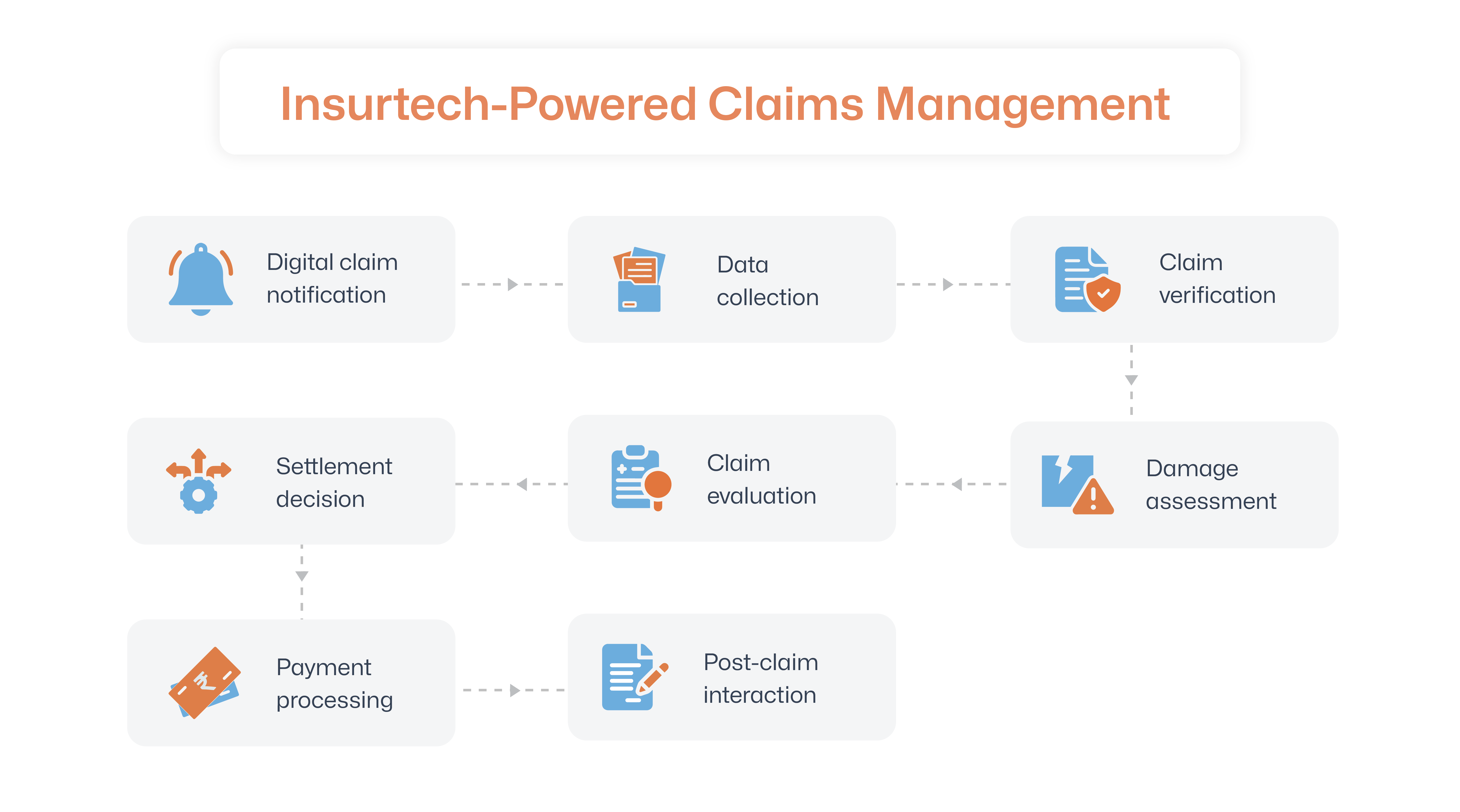

Claims Management

Leverages advanced analytics to determine and flag fraudulent claims.

Makes self-service available to improve post-sales customer experiences.

Instils transparency and finalisation in contracts and claims administration.

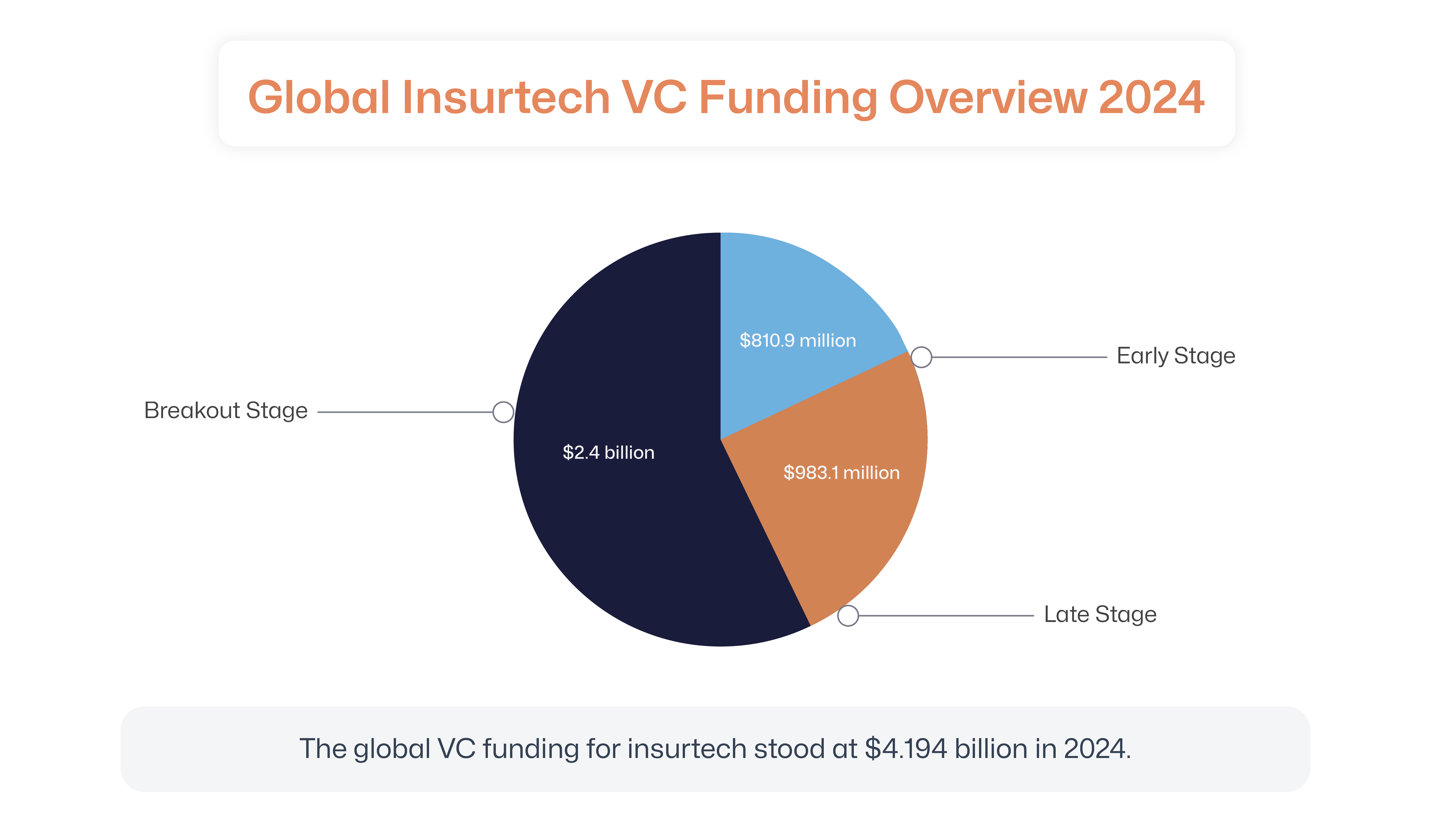

43% of VC funding was concentrated on B2B SaaS (software as a service) solutions.

43% of VC funding was concentrated on B2B SaaS (software as a service) solutions.

On March 31, 2022, life and non-life insurance premiums stood at 7% of the global GDP.

How Does Insurtech Work

Insurtech integrates advanced technologies within insurance processes to drive cost and error reductions and optimise underwriting and claims processing while saving manual effort. Employees are freed to focus on adding greater value.

Various technologies have defined roles in powering the transformation of the insurance industry:

Artificial Intelligence & Machine Learning

AI and ML form the most powerful combination of technologies in revolutionising insurance. The two eliminate the fragmentation in back-office functions. They enable cohesive operations of governance, underwriting and data management processes.

Intelligent automation facilitates cognitive claims management, leveraging real-time data analytics and ML-based predictive and prescriptive insights. Claims can be pre-assessed to evaluate damage, identify fraud patterns and flag suspicious requests, thereby lowering liquidity stress on the insurer.

RPA and Gen AI-driven interaction systems facilitate self-service and offer 24/7 query resolution for customers. These systems also keep track of interactions to offer unified experiences across channels and gather valuable insights to personalise responses and services.

Blockchain & Smart Contracts

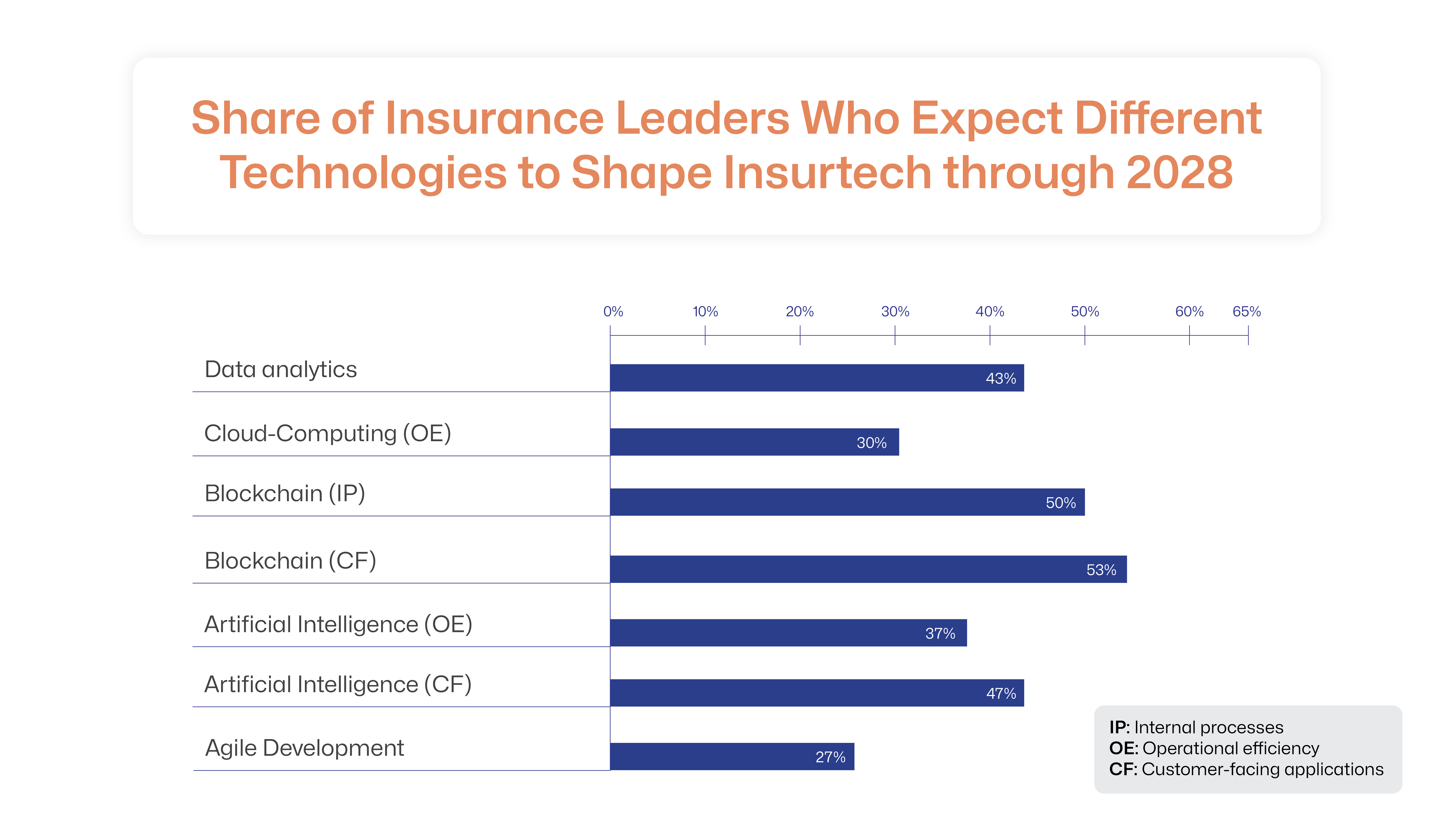

Blockchain technology has several use cases across internal processes and customer-facing applications.

Intrinsically, the technology can optimise internal processes by streamlining claims management. This can be done with automated triggers for claims initiation and processing. Blockchain-based KYC can expedite user identification, while decentralised data storage optimises access and management of user details.

The most obvious blockchain technology use case for customer-facing processes is the use of event-triggered smart contracts. The technology can also support on-demand usage-based micro-insurance models through real-time data analytics. This can facilitate the personalisation of quotes.

Internet of Things (IoT)

Being always connected offers several benefits to the insurance industry, especially for the auto and health insurance segments.

Telematics capture behavioural data that enables insurers to offer usage-based personalised insurance products. These include pay-as-you-drive mechanisms and rewards for safe behaviour. Rewards may include discounts on premium or extended coverage duration. The same holds true for healthcare data, which can help insurers personalise policy terms and assess risk exposure.

Advances in telematics data capture and analysis techniques are paving the way for large-scale commercial insurance solutions, such as those for marine fleets or agricultural businesses.

Big Data & Analytics

Big data is the backbone of insurance digitalisation. Powerful data analytics performed at cloud-based data centres offer digestible insights for AI and predictive systems to draw conclusions. These drive decision-making and elevate insurance product offerings, considering industry trends, regional preferences, individual needs and future readiness.

Cloud Computing

Cloud migration is not new to the insurance industry. However, fintech innovations and SaaS-based offerings have enhanced the ability of legacy infrastructure to harness the value of cloud computing. A cloud-first approach allows insurance providers to leverage SaaS and PaaS (Platform as a Service) solutions with minimal investment and downtime.

A complete technology transition to the cloud or PaaS/Saas integration offers similar benefits to insurers. These include accelerated response time to emerging market needs, scalability to expand or shrink on demand, reliability with uninterrupted data and technology availability, and comprehensive security.

Source: Intellias

Source: Intellias

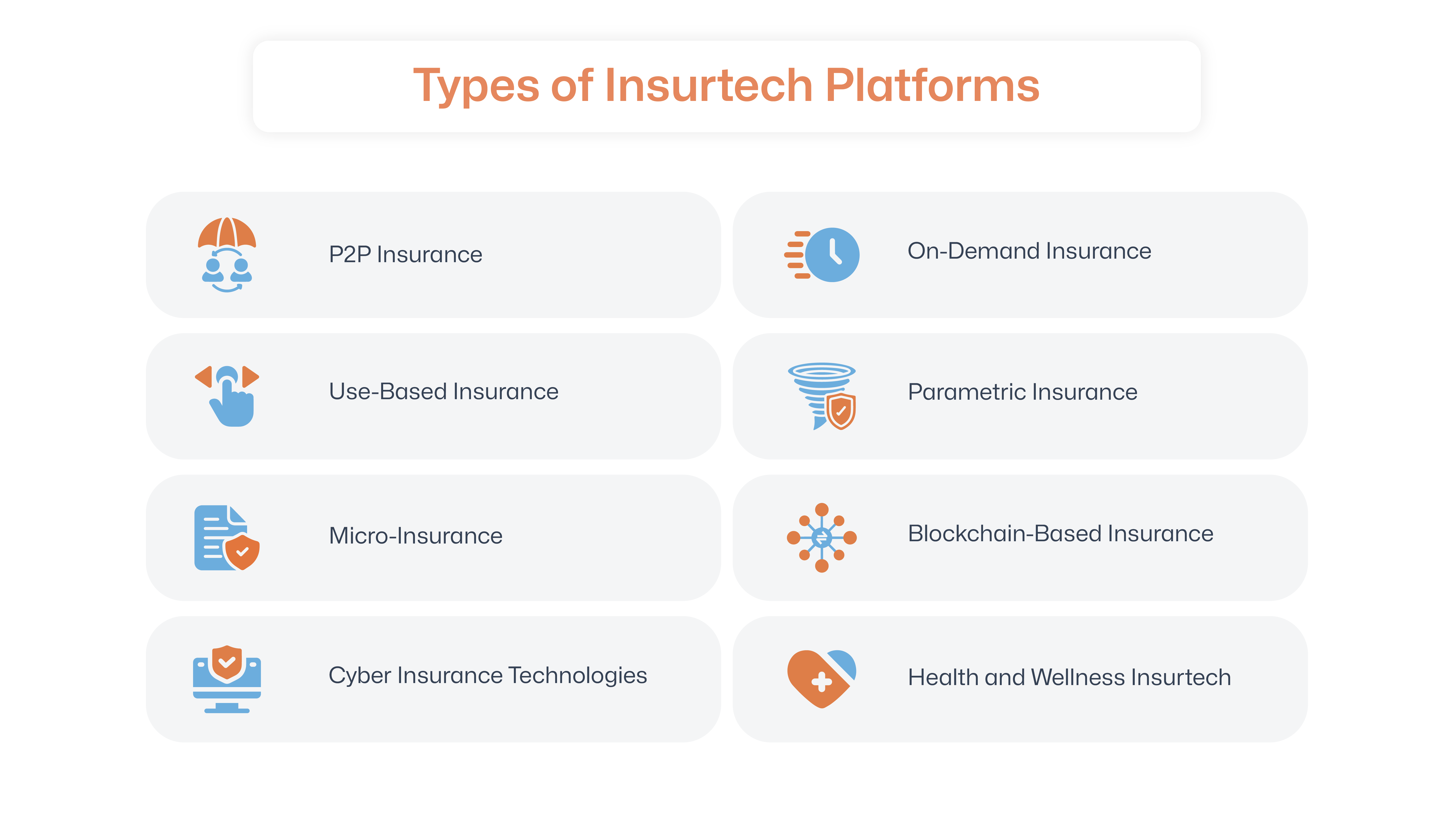

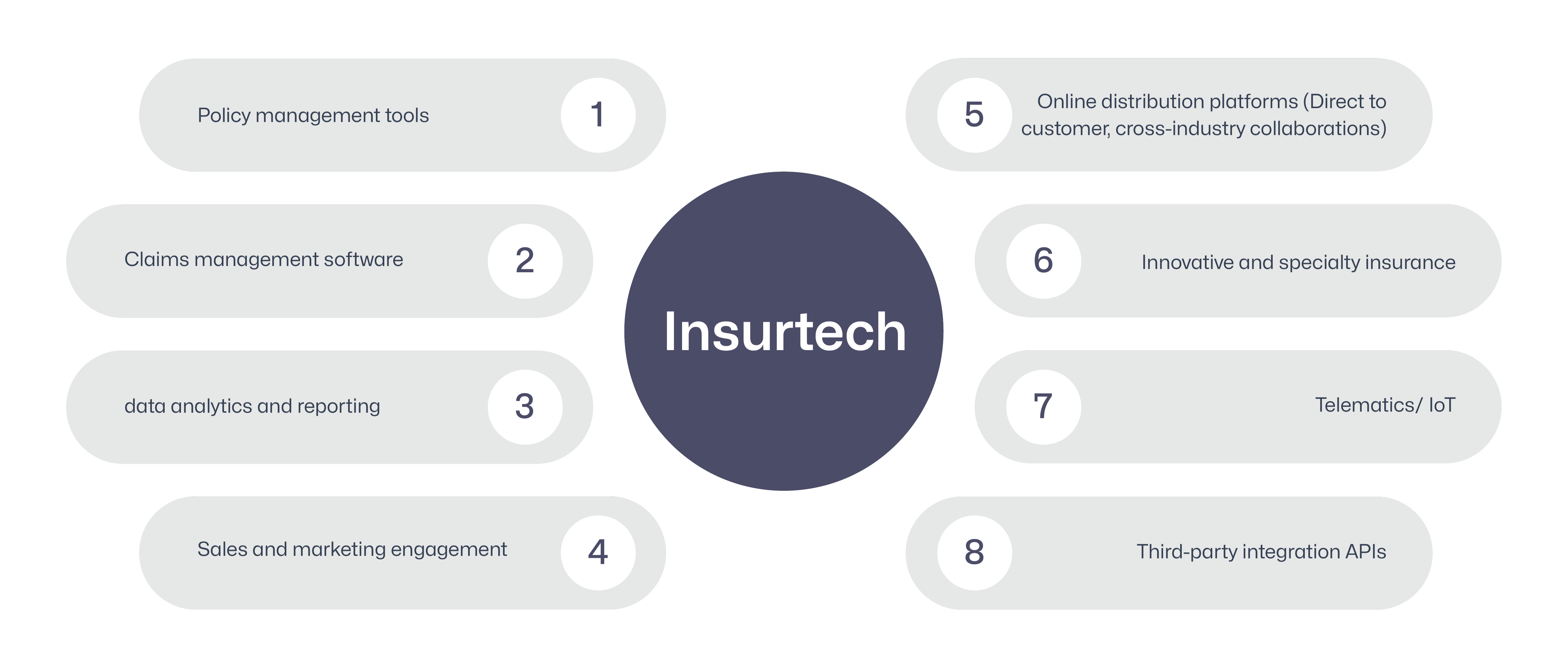

Insurtech Applications

Policy Underwriting Automation: Speed & Precision at Scale

AI transforms underwriting from a lengthy process to a near-instant experience using data analytics. Algorithms assess risk with unprecedented accuracy, enabling faster policy issuance and optimised pricing. This drives customer satisfaction and operational efficiency.

Fraud Detection Systems: Protecting the Integrity of Insurance

Advanced fraud detection systems utilise machine learning to identify and flag fraudulent claims in real time. By proactively mitigating risk, insurtech safeguards capital while ensuring fair premiums for customers.

Claims Processing Automation: Streamlining the Customer Journey

Seamless claims processing with automation enables faster payouts and reduced administrative burden. From initial filing to final settlement, the insurtech platform streamlines every step, providing a frictionless and transparent experience to policyholders.

Personalised Insurance Products: Tailored Coverage for Unique Needs

Insurtech solutions use granular data and AI to drive personalised insurance product creation decisions to precisely match individual risk profiles and lifestyle needs. They help insurance providers to deliver greater value to customers at lower cost.

On-Demand Insurance Models: Adaptability Materialised

On-demand insurance models provide coverage when and where needed, adapting to changing circumstances and offering unparalleled convenience in today’s fast-paced world.

Digital onboarding: Elevating Customer Experiences

Insurtech helps make a great first impression on customers with automated onboarding. Streamlined account setup and navigation through policy terms build customer confidence and drive retention.

Cross-Selling Automation: Multiplying Revenue Streams

Centralised data management and collaboration with diverse parties allow insurers to multiply their revenue streams through automated cross-selling. Automated cross-selling saves marketing and customer acquisition effort.

Propensity Modelling: Improving Product Pitching

In the age of digital marketing, recognising the potential of every lead is critical to streamline customer funnelling. Insurtech empowers insurers to evaluate a potential customer’s likelihood of purchasing a policy based on terms, premiums, and needs.

Source: Redhat

Source: Redhat

How Insurtech Companies are Revolutionising Insurance Distribution

Traditional insurance distribution models rely on agents, brokers and direct channels. Some persistent challenges of these models are inefficient processes, higher costs and mass-produced policies. Insurtech is eliminating these limitations by improving speed, enabling personalisation and enhancing accessibility. Innovations in AI and data analytics deepen the understanding of customer needs and facilitate the creation of new business models. Here’s how insurtech companies are redefining distribution:

Embedded Insurance Models

Insurtech redefines accessibility by embedding insurance directly into non-insurance platforms. For example, purchasing travel insurance alongside flight bookings or auto insurance during car purchase.

This integration delivers instant coverage, eliminating friction and enhancing customer convenience. Insurtech companies partner with e-commerce platforms, OEMs and auto manufacturers to embed insurance within the purchase journey, expanding insurance reach.

Digital Marketplaces & Aggregators

Insurtech platforms drive consumer empowerment. Mobile apps and online portals make it easier for consumers to compare coverage and prices. Digital marketplaces and aggregators enable instant automated comparison of policies and prices from multiple insurers. Utilising AI-driven personalisation, these platforms offer tailored recommendations, helping consumers make informed decisions. These aggregators serve as direct purchase platforms for customers to access their chosen policy effortlessly.

API-Driven Ecosystems

Insurtech leverages APIs to create dynamic ecosystems, enabling third parties to integrate insurance offerings directly into their services. Fintech apps, for example, can offer micro-insurance products, such as loan protection plans, through embedded APIs, expanding insurance reach to new customer segments.

Dive into how Zopper empowered one of India’s largest NBFCs to tap into insurance opportunities. Our unified digital lending platform enabled insurance bundling within customer credit journeys, enabling 5x business growth.

Bancassurance 2.0

Insurtech has paved the way for tech-enhanced bancassurance partnerships. Mobile banking apps, powered by insurtech platforms, offer customised insurance solutions. This synergy streamlines the insurance sales process, delivering convenience and personalised coverage directly to bank customers.

On-Demand & Usage-Based Insurance

Insurtech introduces agility and flexibility with on-demand and usage-based insurance (UBI). Some of the prime use cases are pay-per-mile car insurance and travel insurance that automatically activate upon detecting a trip. These event-triggered models adapt to usage patterns, offering coverage as and when needed and catering to dynamic customer needs.

Discover how Lemonade, a US-based insurer, applied a peer-to-peer insurance model to disrupt legacy insurance models with UBI. It works on the principle of pooling claims, where policyholders pay premiums into a common pool. What attracts customers the most is that if there is money left after the policy period ends, policyholders get a refund. A more innovative approach could be to reuse the funds to lower future premiums.

Sachet Insurance

Insurtech has introduced sachet insurance by digitising distribution, making micro-insurance accessible via mobile apps and online platforms. Targeted, short-duration coverage fulfills customers' immediate needs using real-time data analytics while helping them diversify their protection portfolios. Bite-sized policies allow insurers to acquire new customers, build brand image, and collect user insights to offer more targeted policies.

Key Insurance Industry Challenges That Insurtech Can Help Tackle

Traditionally, insurance has relied on manual processes, which are highly inefficient and error-prone. A crucial drawback of manual adjusters is that the evaluation of risk and fraud is limited to human judgment, which is often not inferred from data but from instinct. The manual progression of every prospective client through the sales funnel can be time- and cost-intensive, with significantly lower reachability. For a long time, insurance policies have been rigid and mass-produced. With growing demand for personalisation, the scope and coverage needs of individuals and organisations have evolved significantly, which umbrella policies cannot fulfil.

Insurtech solves several key challenges of the traditional insurance industry:

Manual Onboarding

Paper-based processes lead to gaps in the customer’s understanding of the policy.

Insurtech Solution

The low frequency of customer interactions in the insurance industry necessitates the creation of positive experiences for each customer. Onboarding is the first after-sales customer experience with an insurer. The average CSAT (customer satisfaction) score for insurance customers is 5.8 across all channels. The score highlights the need and scope for elevating experiences while insurtech creates opportunities in the digital space. Insurtech enables insurers to offer intuitive and pleasant onboarding experiences. Users can access digital dashboards at their convenience without being forced to grasp everything at once.

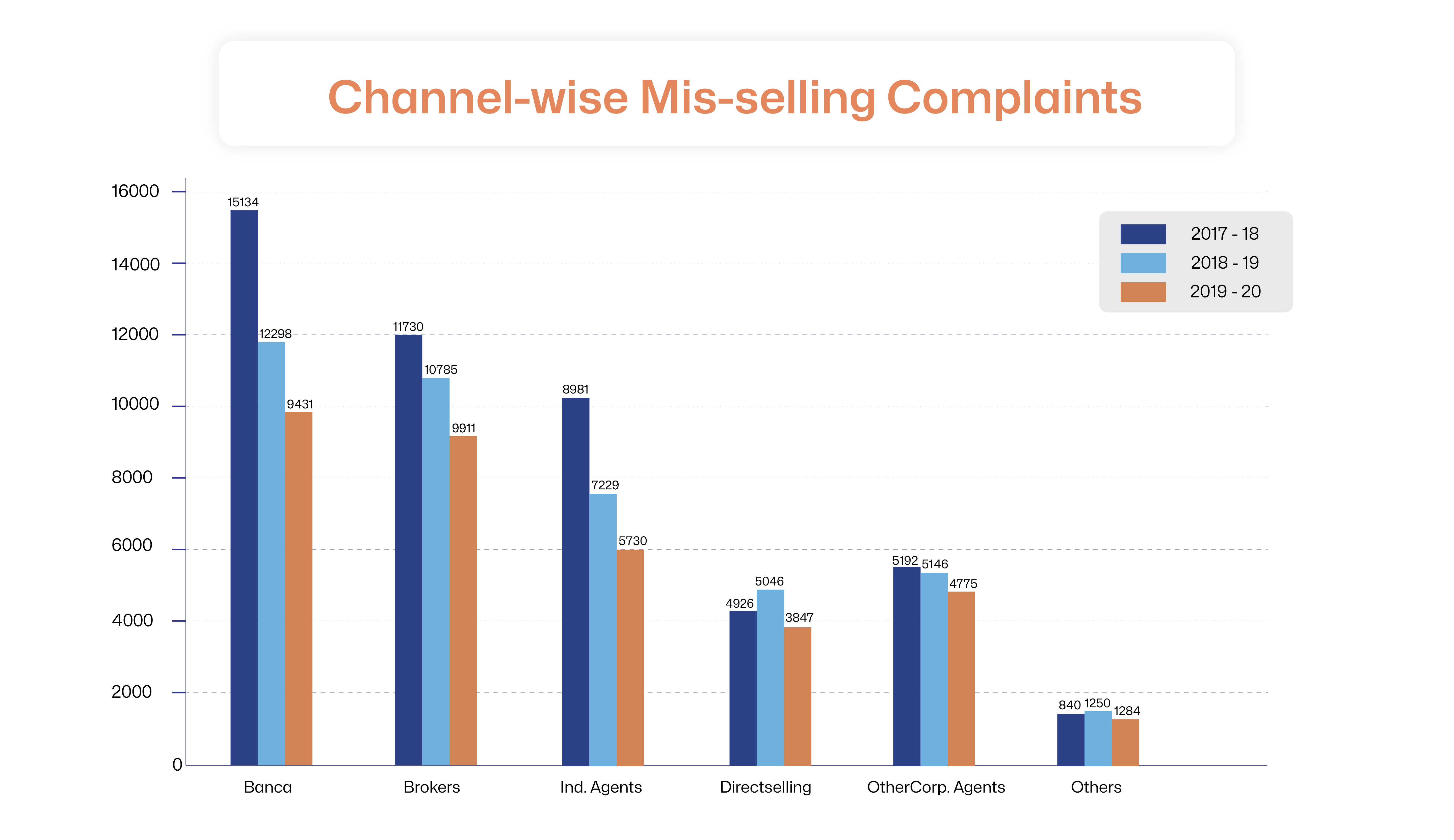

Mis-Selling Policies

The rampant problem of agents mis-selling to meet their targets erodes customer trust.

Insurtech Solution

In FY 2023, 58% of valid complaints against life insurance providers in India were related to mis-selling. These include mentioning policy terms in a twisted manner or missing out on finer details. Transparency goes both ways. Insurtech facilitates insurers in managing compliance and standardising policy information while maintaining comprehensibility. Insurtech platforms also enable a gamified approach to ensure that the customer easily understands policy terms. Thanks to insurtech, Wrisk, a Germany-based auto-insurance technology partner, has introduced a scoring mechanism. It makes customers aware of policy risks in a digestible format. That is thoughtful and practical.

Source: Binary Semantics

Source: Binary Semantics

Inefficient Claims Processing

Lengthy manual processes lead to delayed settlements and customer frustration.

Insurtech Solution

Automated claims processes accelerate approvals. Early-stage insurtech solutions employ optical character readers to expedite data extraction, reduce manual data entry errors and ensure data integrity. With cloud-based digital claims filing and self-service availability, this is further sped-up. Errors on the part of the customer are quickly identified and reported. Early detection and rectification improve customer satisfaction. Advanced AI-powered claims processing solutions utilise machine learning and third-party data to accelerate the movement of claims to disbursal. Lemonade’s workflow automation has reduced the average claims settlement time from 11 days to one day. These platforms also offer greater control over managing the policy, setting premium reminders and accessing self-service support.

Fraud Detection & Risk Management

The inability to keep up with fraudsters costs the industry billions annually.

Insurtech Solution

Staying a step ahead of fraudsters is critical to combating fraud in the insurance industry. With cybercriminals using sophisticated technologies, detecting fraud and mass attacks has become more challenging. This is where insurtech levels the playing field through technologies like AI, blockchain and big data analytics. It enforces transparency right from the point of sale of the policy using blockchain-based smart contracts. Smart contracts eliminate the possibility of tampering with the policy terms or any other aspect of insurance. This maintains data integrity across processes. Big data analytics-based automated checks match the claim request against recorded and learned patterns, along with prevalent trends to identify fraud. These tools flag suspicious claims early. Clearspeed, for instance, a UK-based insurtech company, takes decision-making a notch higher. It powers its insurance partners to accelerate decision-making through AI-powered voice analytics, which flags fraudulent claims with an accuracy of over 97%.

Lack of Personalisation

Traditional one-size-fits-all insurance products fail to meet individual needs.

Insurtech Solution

The insurance industry is exposed to a wide variety of risks. These include risks associated with natural disasters, respective job roles and income sources of individuals, work-related hazards of organisations, and a country’s exposure to global events. Against this backdrop, inflexible insurance policies with one-size-fits-all pricing no longer works. For instance, within India, there are zones of varying risk of seismic activity, floods and drought. Insurtech applies analytics to huge volumes of data to adequately evaluate risk and offers tailored policy terms, coverage, duration, exclusions, premiums and deductibles. Insurtech has also enabled floating claim plans for organisations, lowering the cost burden on employers while providing requisite coverage to employees. Telematics-powered data analysis facilitates behaviour-based policy creation. Insurtech has also made short-term and on-demand policies available.

Customer Engagement & Retention

Legacy insurers struggle to maintain meaningful engagement with policyholders.

Insurtech Solution

Engagement drives loyalty. Legacy insurance processes are fraught with friction in customer engagement, especially post-sales. Long-winded customer experiences prevent meaningful interactions. Human representatives might be unavailable to answer queries on demand, or worse, when an incident occurs. TrackActive, for instance, is an Australia-based exercise prescription platform. It allows doctors to monitor patients’ activities to facilitate faster recovery while flagging potentially risky behaviours. Ensuring customer engagement and maintaining transparency drives retention. Modern multi-channel insurtech platforms make insurance providers approachable and accessible, redefining customer experiences. Fixed-logic and Gen AI chatbots, accessible via mobile apps, website or phone calls, conduct empathetic contextual conversations. They also track interactions to avoid repetition, often leading to customer frustration. Hybrid conversation mechanisms allow human intervention when necessary, keeping customer needs at the fore, which fosters loyalty and improves retention rates.

Regulatory Compliance Complexity

Navigating the complex regulatory landscape is time-consuming and prone to errors.

Insurtech Solution

Compliance can be daunting, given the evolving regulatory landscape and digitalisation-enabled market expansion. The insurance industry is one with stringent oversight, given its critical impact on a policyholder’s life. Regtech solutions, a subset of insurtech, automate compliance processes. They instil agility in adapting to emerging compliance guidelines, ensuring real-time adherence to regulations. Blockchain-based automated smart contracts enforce compliance, while AI-powered reporting minimises operational risks. These translate into protection against penalisation risks, reputational damage and loss of customer trust. US-based Monitaur, for instance, is a dedicated AI-powered governance platform. It employs a “policy to proof” model to simplify governance, improving compliance efforts.

High Operational Costs

Legacy systems and manual processes raise operational expenses.

Insurtech Solution

Cloud-based platforms offer flexible and scalable solutions across operations and backend processes. These are usage-based platforms that optimise technology infrastructure-based expenditures. Automation reduces employee workloads, lowering manual effort and administrative costs. Improved risk analysis and underwriting enhance overall policy approval cost and liquidity management. Precise claims assessment prevents insurance fraud, and ongoing audits ensure continued compliance, adding to the savings.

Limited Access to Insurance

Insufficient distribution channels and a lack of awareness lead to underinsurance.

Insurtech Solution

Insurtech has redefined business models for insurance providers. Mobile-first and digital distribution models expand insurance access to remote and underserved populations, especially in emerging markets such as India. Insurtech enables insurers to identify the most popular channels to reach the underserved cohorts. For instance, they can use a locally popular social media channel to raise awareness about insurance, biometric ID, digital signatures, and other processes to apply for and claim insurance. These channels can also be used to address inherent mistrust issues in the industry.

Create Carousel (3 slides – For Insurers, For Policyholders, and For Brokers/Partners)

Key Insurtech Trends to Watch in 2025

The most prominent trend in the insurance industry is the emergence of a unified digital ecosystem. Multiple stakeholders working together to offer adequate protection while sharing risk using advanced data and predictive analytics. For instance, consider a farmer purchasing crop insurance. The insurer collaborates with IoT device providers to gather accurate weather, soil health, farming practices and regional disruptions data. Smart contract-powered claims management allows the farmer to effortlessly get his dues without delays. Such an ecosystem is on the horizon. The collaboration of insurtech providers with diverse stakeholders can facilitate the formation of a unified insurance ecosystem.

Take a look at the specific technology trends shaping the future of insurance technology:

Rise of Embedded Insurance

The digitalisation of businesses has enabled insurers to embed their products within the purchase journey. Property and casualty, mobility and transportation, and pet care are poised to surge. Travel and electronics insurance are the strongest propellors of the embedded insurance market, which is expected to reach $950.59 billion by 2030.

Growth of Parametric Insurance

Parametric insurance works on predefined triggers. A third party objectively evaluates events against a threshold value, for instance, rainfall on agricultural land, and triggers payout if the conditions are met. This eliminates financial uncertainty, expedites capital disbursal and ensures transparency. With the growing intensity and frequency of climatic disasters, natural catastrophe insurance is projected to account for 56.7% of the $62.7 billion parametric insurance market by 2037.

AI-Driven Risk Assessment

The diversity among individual profiles is increasing, which calls for more sophisticated risk assessment systems. AI-powered insurance underwriting and risk evaluation improves pricing accuracy by 15%. AI/ML not only facilitate more accurate pricing but also empower insurers to develop robust risk mitigation plans. The AI in insurance market is forecasted to be valued at $91 billion by 2033.

Usage-Based Insurance Models

Telematics-powered usage-based insurance is expected to create a $232.94 billion opportunity by 2032. Connected vehicles and wearables integrated with OBDII (on-board diagnostics II) technology are the key drivers of UBI. These are set to encourage safer behaviours and improve customer-insurer relationships.

Future of Insurtech: What Lies Ahead?

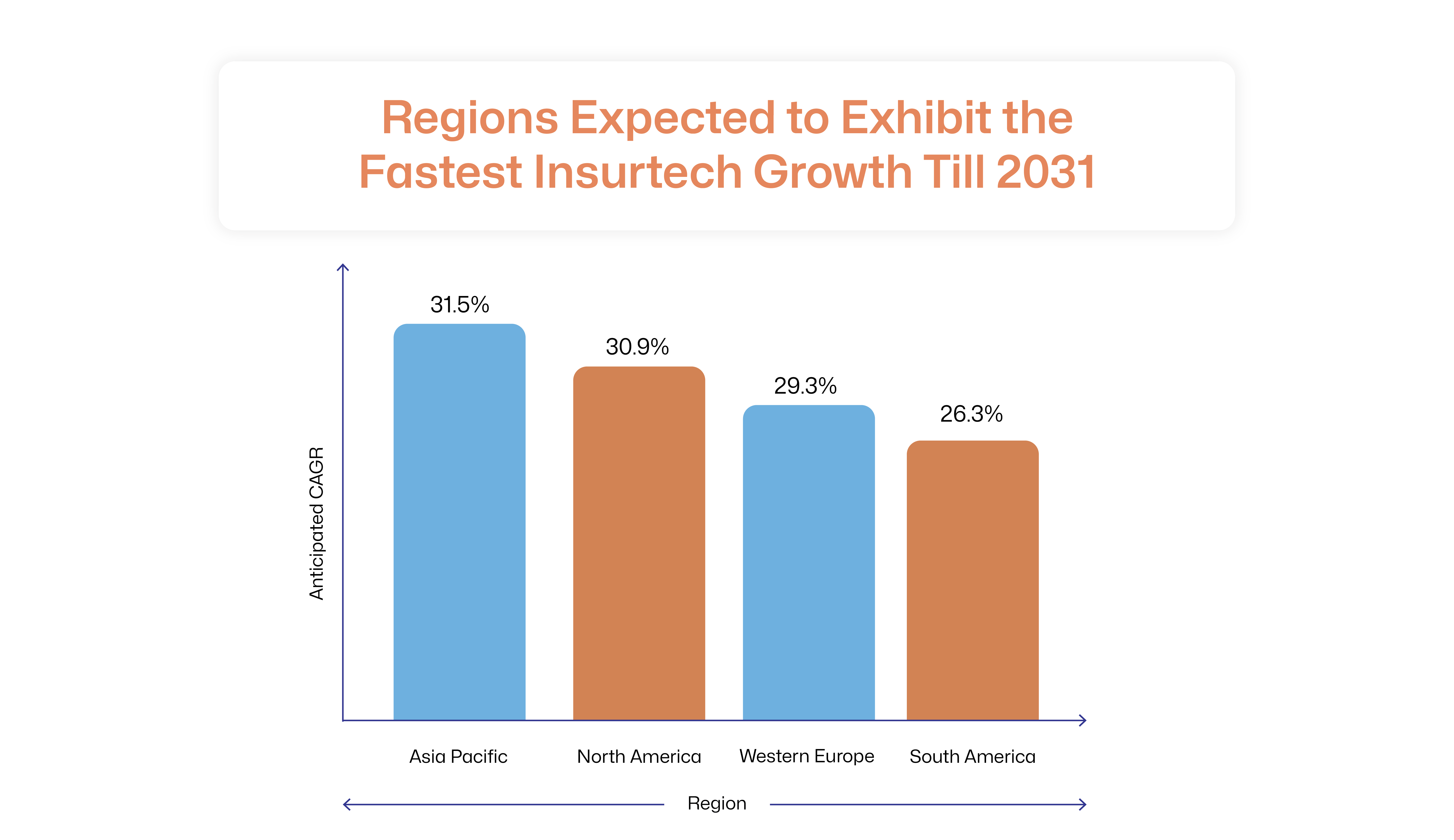

The insurtech industry is predicted to grow at an explosive CAGR of 43.6% from 2025 to 2029, reaching $114.39 billion.

Emerging Markets for Insurtech

Source: The Business Research Company

Source: The Business Research Company

Top 3 Predictions from Industry Experts

“As differentiation remains a top priority for P&C carriers and brokers seeking to capture market share, investment in technology that is innovative and enhances the customer experience will be key.” - Ken Tolson, CEO of Turvi

“The risk and economics of modernisation will fundamentally change in 2025, forcing the industry to take action.” - Accenture

There will be “increased venture capital (VC) investment in Insurtech companies, while carriers will actively pursue MGAs. Insurtech platforms will be pivotal in ensuring seamless integration and standardised operations across acquired companies.” - Fintech Global

Insurtech Innovations to Shape a Green Future

Insurtech will play a critical role in sustainable insurance by leveraging satellite imagery to determine environmental impact and identify risk hot spots for the industry. The industry is set to encourage a transition to the use of clean energy sources for data management, distribution and operations. Insurtech is set to encourage the assessment of and reduction in the environmental footprint to price policies, driving a broader change.

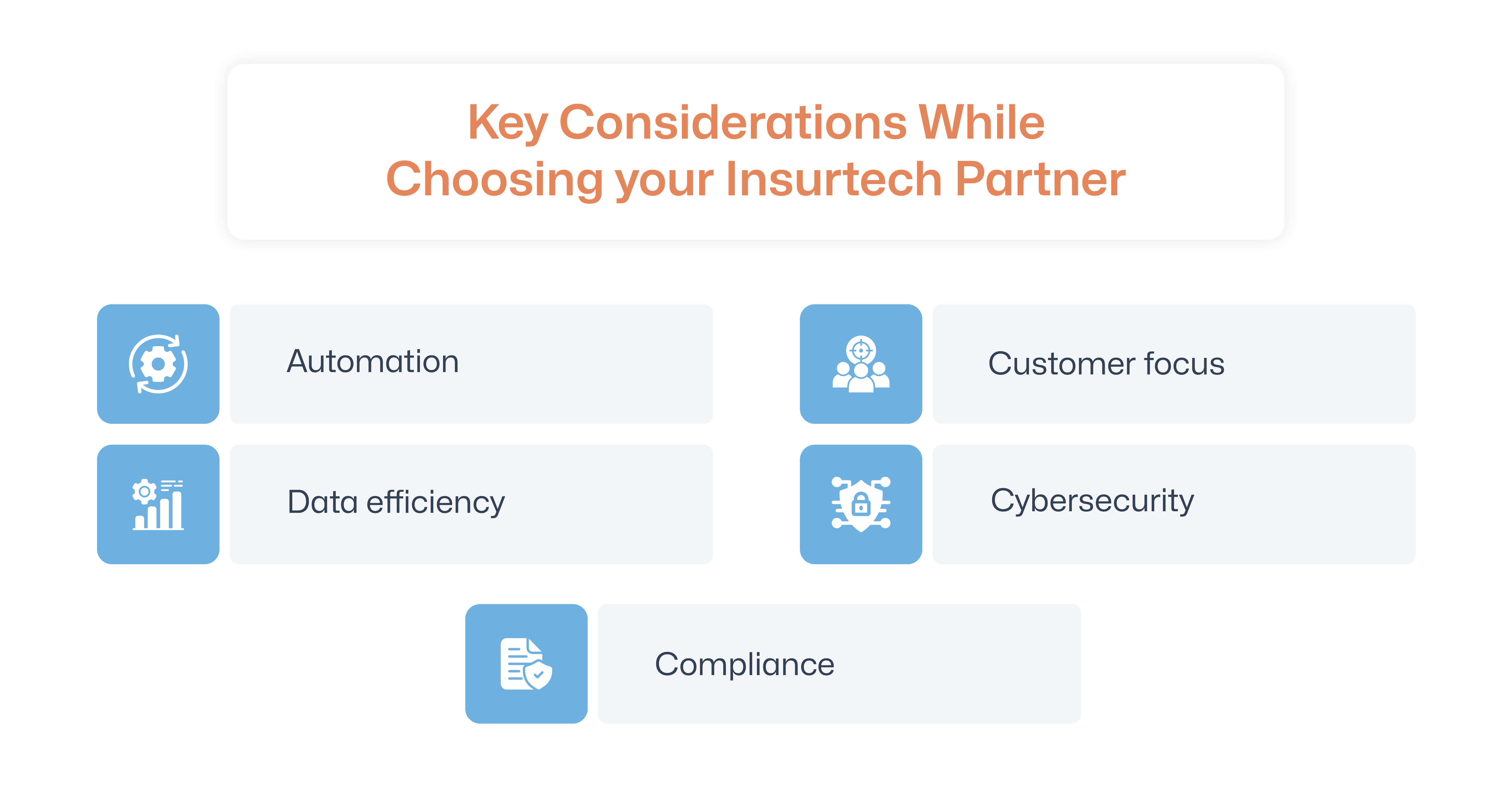

How to Get Started with Insurtech Solutions

Insurtech success relies on careful planning and appropriate technology integration. Here is a list of success drivers for various parties:

Insurance Providers

The good news is that insurers do not need to overhaul their entire technical infrastructure to integrate insurtech solutions. Here is a step-by-step guide for insurers to adopt insurtech:

Assessment and Planning

Start by identifying key operational pain points. Onboard all stakeholders to gather more inputs and align insurtech initiatives with business goals.

Choose the Insurtech Solution

Conduct thorough market research to identify insurtech platforms with the most suitable features, ease of integration, compatibility with existing systems, etc. Evaluate insurance technology providers based on their services, future-readiness and industry experience. You must also seek proof of concept and consider past projects to gauge the efficacy and reliability of the provider.

Integration and Implementation

Organise and cleanse data while initiating API-based integrations to optimise workflows. Address data quality issues and eliminate inconsistencies.

Change Management

Inculcate tech-readiness and a data-first mindset among employees. Employees must be educated about their evolving roles and responsibilities. Start by training them with a pilot solution to refine the insurtech application and offer hands-on experience. Opt for a phased roll-out to monitor the transition and minimise business disruption.Monitoring and Optimisation

Develop KPIs according to the business goals established in Step 1 and define metrics to measure progress. Leverage cloud-based CI/CD pipelines for feedback loop integration and ongoing adoption of emerging technologies.

Entrepreneurs/Startups

The insurtech space is a treasure trove of opportunities for technology-based startups and entrepreneurs with an inclination to improve insurance coverage for underserved and unserved groups. Here is a guide to building or investing in insurtech solutions:

Discover Opportunities

Conduct thorough research to identify market gaps and align your value proposition to bridge them. You can collaborate with an insurtech provider to give you first-hand insights into untapped opportunities.

Devise a Business Model

Choose your operational model (direct, embedded, B2B, etc.) and form necessary collaborations with experienced liquidity, technology, risk management, and insurance experts.

Develop Technology Infrastructure

Employ cutting-edge technologies and develop a user-centric platform. You can also use a white-label platform and tailor it to your brand to improve speed to market. Ensure that data security and compliance are integrated within the insurtech tool set.

Invest in Growth and Scaling

Create differentiated offerings, leveraging data while targeting your chosen cohort. Align your marketing, distribution, interaction and policy terms to the audience’s needs. Evolve with the market.

For Consumers

Policyholders can maximise insurtech benefits by making the right choice of insurance policy and provider. Here’s what to look for when searching for a suitable insurance product:

Testimonials of the insurance provider and the insurtech partner.

Policy that is comprehensive and ready for the future.

Guaranteed renewals to ensure the coverage continues.

Riders, i.e., supplementary coverage options.

Personalised policies with the flexibility to evolve with your changing needs.

Multi-mode payment options.

24/7 barrier-free customer services via digital channels.

Economy-based products, such as those that consider inflation instead of static ones.

Excellent security of your personal data and sensitive information.

Frequently Asked Questions

Q1. What is the difference between insurtech and traditional insurance?

Answer: The primary difference between insurtech and traditional insurance is that while the latter relies on manual effort, the former employs advanced technologies across policy creation, underwriting, distribution and settlement processes. Insurtech uses technology to improve traditional processes for greater efficiency, and enhanced communication, risk assessment and turnaround times. Cost, vulnerability to manual error and paperwork are simultaneously reduced. With advances in Gen AI, insurtech can humanise digital interactions and offer empathetic solutions for policyholders’ concerns.

Q2. Is Insurtech safe and reliable?

Answer: Insurtech leverages cutting-edge technologies to ensure regulatory compliance and maintain robust security against cyber threats. It arms insurance providers to satisfy the most stringent oversight and protect against sophisticated threats.

Q3. What types of insurance are most impacted by insurtech?

Answer: Insurtech has the highest impact on the auto insurance, health and wellness protection, and cyber insurance segments. Emerging models, such as on-demand, pay-as-you-sell, UBI and parametric insurance are a result of insurtech applications.

Q4. What role does AI play in insurtech?

Answer: AI is one of the most significant technologies driving the insurtech revolution. AI enables 24/7 customer services with empathetic contextual conversations. AI improves risk assessment and fraud detection, making underwriting and claims processing more accurate and efficient. The technology facilitates the development of products, leveraging data insights, which helps enhance the insurer’s market response velocity and personalisation.

Q5. How can insurtech make selling and cross-selling insurance easier?

Answer: Insurtech leverages data from diverse sources to offer a more comprehensive view of customers. This allows insurers to identify opportunities and create targeted policies. For instance, a travel insurance buyer may also buy a sachet backpack insurance.

Q6. How can e-commerce and fintech platforms integrate insurtech solutions?

Answer: E-commerce and fintech platforms can use APIs to integrate insurtech solutions within their offerings. Since they already have scalable distribution networks in place, the cost and time investment for expanding their offerings with embedded insurance are significantly lower. The key is to identify the opportunities and devise a compliant operational model to distribute and manage insurance.

Q7. Can insurtech help increase topline/revenue for banks, MFIs, OEMs and travel aggregators selling insurance and assurance plans?

Answer: Certainly. Forming strategic partnerships with insurtech-equipped insurance providers can help protection reach the last mile. Embedding insurance into existing offerings can increase revenue streams, which has a direct impact on the topline.

Q8. How do insurtech companies enable embedded insurance for travel aggregators, digital companies and OEMs?

Answer: Customers of the digital age prioritise convenience. They don’t want to visit multiple websites or read through complex policy wordings. Travel aggregators, digital companies and OEMs can leverage API-based integrations to bundle their products with insurance products and embed them with their primary offerings. This eases the customer’s search for insurance cover and strengthens customer trust in the provider.

Q9. How can SMEs and startups benefit from insurtech?

Answer: Insurtech paves the way for tailored insurance products. By collaborating with reputed insurtech providers and insurers, startups and SMEs can choose the most suitable group and commercial insurance on-demand. Insurtech also enables pay-as-you-use and floating premium plans, making coverage more affordable.

Ready to Embrace the Future of Insurance?

Insurtech is a critical force driving the Indian vision of including everyone under the protective umbrella of insurance by 2047. Consequently, the insurtech market size in India is expected to reach $307 billion by 2030, growing at a CAGR of 17% from 2025. Zopper is a leading end-to-end insurtech provider that infuses insurance and technology to offer flexible, scalable and affordable solutions. Our pan-India footprint positions us to build a robust, unified ecosystem for seamless insurance operations. Contact us today to learn how our insurtech solutions can transform your business.