The insurance industry has a growing need to support wellness and security. Rising polarisation and economic inequality, widening expense and savings gaps, and ageing populations create structural challenges for the industry. The always connected and mobile world is pushing insurers to innovate while creating growth opportunities for themselves. Keeping up with changing customer requirements while navigating regulatory complexities is becoming increasingly challenging. The most significant advantage of digital insurance solutions is its ability to unify data, people and processes into a cohesive whole. This offers several benefits to insurance providers.

Opportunities Created by Digitalisation

In addition to the direct benefits mentioned above, digitalisation has created several opportunities for insurers to multiply their revenue streams.

Tech-Led Product Distribution

Digital distribution of insurance policies saves several hours of agents’ time, physical document creation and mailing expenses, and simplifies policy management.

Strategic Cross-Selling

Inter-process and third-party integrations have enabled insurers to create parametric products and carry out more sophisticated underwriting and risk assessments.

Embedded Insurance

Embedding insurance products (from devices to real estate) within the sales pipeline significantly reduces customer funnelling and acquisition investments for insurance providers.

Flexible Insurance Products

Telematics have empowered insurers to offer usage-based and bundled insurance products. This instils greater personalisation and customer-centricity in the insurance ecosystem.

Risk Sharing

Parametric solutions and public-private partnerships to drive the “insurance for all” mission facilitate risk transfer while lowering insurer liability.

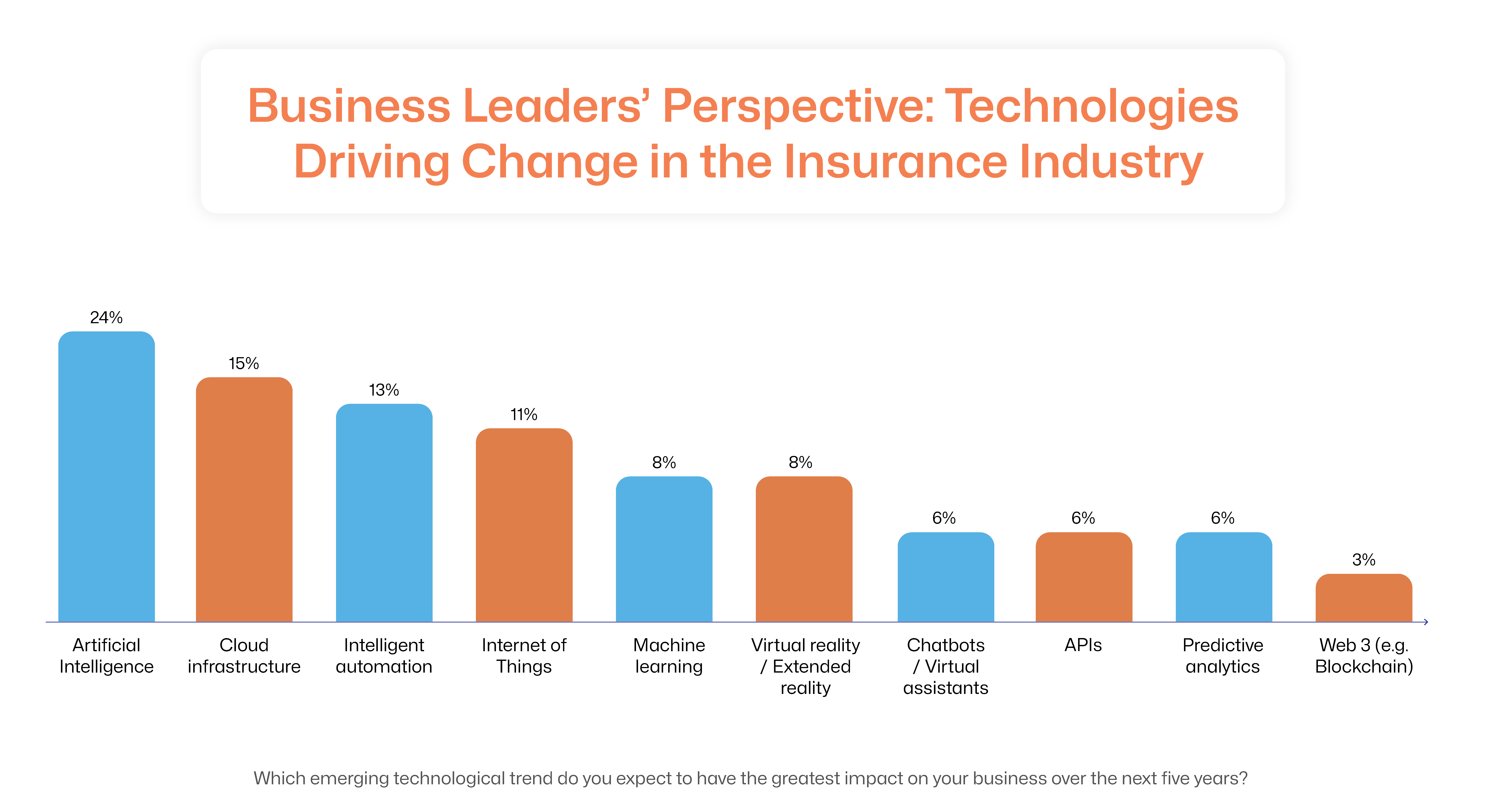

The Rapidly Evolving Digital Insurance Landscape

A key aspect of the digital revolution is re-imagining the business model, operational strategy and risk posture with a technology core.

Tips to Keep Pace with the Digital Revolution

The insurance industry is rapidly adopting innovative techniques to maximise the benefits from digital solutions. Some techniques to gain a competitive advantage include:

Cloud Migration

Cloud-based technological infrastructure empowers insurance providers to respond to market needs with agility. On-demand scalability offers cost-effective mechanisms to manage varying traction volumes and expand into new markets.

Data Modernisation

Data is the future of underwriting. Advanced data management techniques via superior data platforms, integrated with core processes, enable faster analytics and better decision-making.

Intelligent Automation

From customer interaction to operations, AI-powered automation improves every aspect of insurance processing. Employing robotics and Gen AI streamlines processes to boost efficiency. 8 in 10 companies have plans to enhance AI investments underway.

Predictive Analytics

Machine learning-powered digital insurance solutions allow insurers to recommend personalised policies. Predictive analytics empower insurance providers to assess market and individual needs to offer relevant, on-time products. It also switches risk assessment from being focused on hindsight to a more proactive one.

Cyber Resilience

API-based digital insurance solutions can be integrated with cutting-edge cybersecurity systems. Robust cyber resilience across databases, operations and third-party integrations offers stronger protection against cyber risks.

Blockchain Adoption

According to an EY report, trust and transparency in the insurance provider can enable insurers to reduce the protection versus savings gap. The secure blockchain technology has given birth to smart contracts. Digital agreements instil greater transparency and trust in the insurance ecosystem.

Business Unification

Eliminating silos across diverse processes, such as CRM, life insurance, device insurance, home insurance, etc., can be a game-changer for insurers.Digital insurance management solutions take care of managing individual workflows, while offering a 360° overview to improve risk analysis, facilitate product innovation and drive customer engagement.

Organisational Culture

Building a culture of tech-forwardness within the organisation helps maintain modernisation at par with the speed of tech evolution. A mindset of adaptability and innovation ripples down from the leadership to frontline workers. This drives sustainable digitalisation.

Becoming a Technology-First Insurance Provider

The key to positioning yourself as a tech-first insurer is to innovate purposefully.

The Evolving Digital Insurance Market

Decision-making processes need to be shifted from what works to what will work. Prioritising on features that customers need can boost engagement. Making the products flexible and evolutionary to keep pace with evolving customer requirements can attract loyalty. Facilities, such as adjustable coverage, flexible premiums, pay-as-you-sell models and targeted recommendations, can be a winning business strategy. Collaborative approaches, such as bancassurance, pension dashboards and employer profiles, can potentially enhance growth opportunities.

The Intensifying Risk Landscape

Climate change is leading to an increase in the frequency and intensity of weather events. This translates into greater risk for insurers. Your pricing, risk assessment and underwriting models need to evolve constantly to remain profitable. The regulatory scrutiny on insurers is also intensifying, given the high risk they take and the volume of sensitive data they process. This calls for rapid adoption of the latest regulatory guidelines and strong governance to minimise penalisation risks. Last, but not the least, the cyber threat landscape is constantly evolving into a more sophisticated and pervasive challenge. This demands robust security measures that can adapt quickly to changing cybersecurity needs.

The catch is that these require extensive technical expertise, in-depth regulatory understanding and development velocity. Which insurers often do not possess. So, how do you capitalise on digital solutions for insurance?

Form Strategic Partnerships

Partnering with an experienced insurtech provider can elevate your digitalisation efforts. Digital transformation is not just about adopting the latest tools. It requires strategic migration of data and processes to modern platforms, educating your team, and transitioning with minimal downtime to avoid business disruption or loss. This is where experience in the insurance industry and expertise with innovative technologies can help. Trusting customisable white-label platforms that evolve with technological advances can keep you at the forefront of innovation.

Bibliography (Last accessed on Feb 27, 2025)