Bancassurance is “a valuable tool for developing insurance in emerging markets,” says the World Bank. This is because bancassurance combines the trust of banking and the security of insurance solutions. Dive into how insurtech providers supercharge the synergy of banking and insurance.

What is Bancassurance?

Bancassurance is a partnership between banks and insurance providers to improve coverage and penetration. Insurtech empowers insurers to leverage banks’ extensive and robust distribution channels to sell insurance products.

There are several advantages of bancassurance for banks:

Multiplying revenue streams

Improving customer relationships

Discovering cross-selling opportunities

Lowering distribution costs

Insurtech Improves Banks’ Insurance Offerings

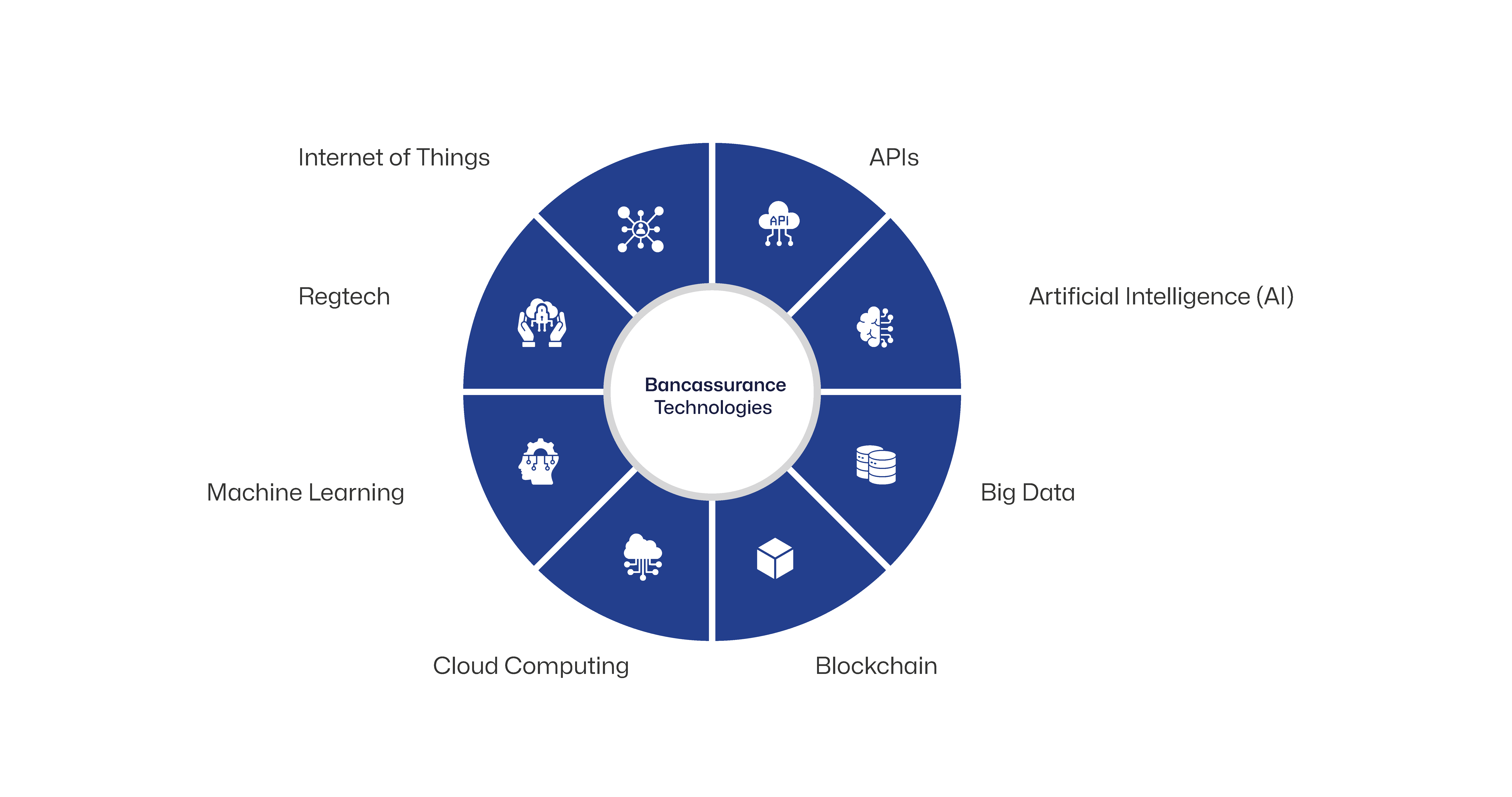

Insurtech leverages the cutting-edge approach of open banking to empower banks to improve their insurance offerings. Tech-powered insurance solutions serve as agents of change, helping banks to elevate their insurance offerings with:

Digitalisation of Operations

Insurtech enables banks to embrace digital operations effortlessly. Insurtech providers leverage API-powered seamless integrations with the existing architecture. This yields speed, efficiency and accuracy.

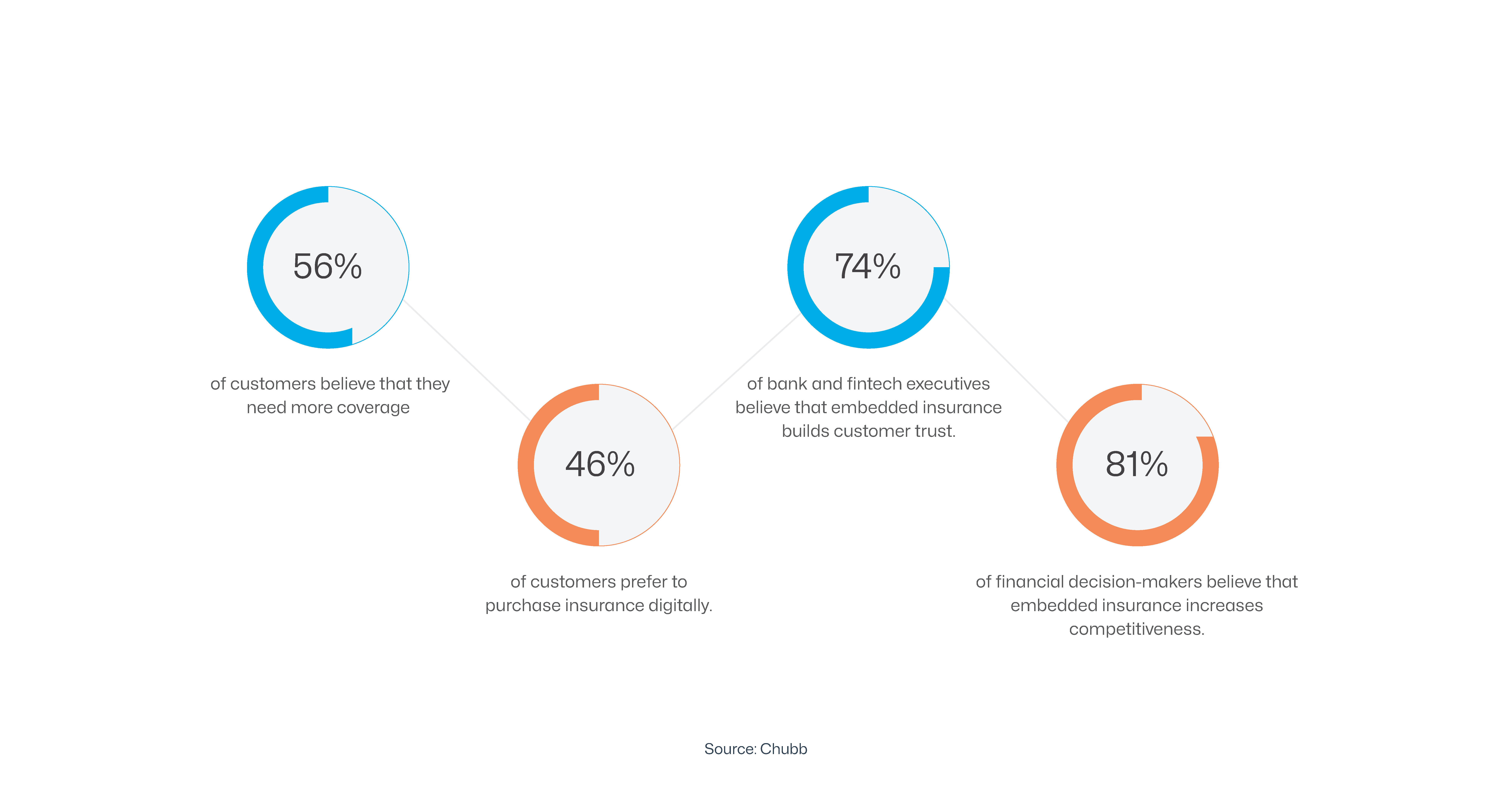

Insurtech-powered 24x7 mobile availability significantly enhances the accessibility of insurance products. As customers increasingly prefer digital channels to discover, compare and purchase policies, exceptional digital services are a must-have for banks to optimise bancassurance ROI. Cutting-edge insurance solutions equip banks to offer consistent omni-channel experiences across touchpoints. Reduced manual documentation lowers the occurrence of errors and improves customer onboarding experiences.

A key benefit of digitalisation is catering to the need for immediacy among tech-savvy customers. In the age of one-day delivery, insurance without real-time response to customer queries is a recipe for failure. Insurtech enables real-time access and analysis of user data, which can be used in IoT-based and other offerings to accommodate customers’ coverage needs in real time.

Personalised and Context-Specific Offerings

Insurtech providers enable banks to collaborate with pure-play insurers and leverage overall customer data. This offers a “unified view” of customers’ coverage needs, financial behaviours and insurance preferences. Banks can create more targeted policies to address the unique needs of customers. For instance, a car purchase could be accompanied by auto insurance or a sachet ride-sharing insurance while booking a cab. Insurance solutions equipped with data analytics enable banks to identify specific needs and buying patterns, which increases the chances of a sale.

Collated user data also enables banks to bundle diverse products by discovering cross-selling opportunities. Banks can sell more without overwhelming the customer. For instance, a woman’s prenatal care package purchase indicates an upcoming opportunity for a pregnancy protection rider over health cover. Noticing and responding to emerging needs can strengthen brand-customer relationships and improve customer satisfaction.

Risk Intelligence and Pricing

Insurance is often an alien domain for pure-play banks. Insurtech providers, however, have expertise in leveraging cutting-edge technologies, such as AI and big data analytics, to enhance risk assessment and mitigation capabilities for banks. Insurtech, therefore, plays a crucial role in improving risk management for banks.

Identifying defaulters in credit card payments indicates premium delays, which can impact the insurer’s liquidity. Having this knowledge can allow the bank to create smaller and more frequent premiums and enable proactive customer notifications to prevent policy abandonment. Such knowledge of customers’ overall financial persona translates into better premium pricing, fraud detection and claims settlement.

In addition to customer-side risks, insurtech empowers banks to alleviate cyber threats. AI-powered integrated insurance technology solutions learn from prevailing fraud mechanisms and recognise claims patterns to discover suspicious activity, enhancing overall fraud resilience for the bank.

Customer-Centric Innovation

Bank and insurance operations have undergone a seismic shift in moving away from one-size-fits-all products. Instead of static customer segments, insurtech empowers banks to create dynamic and flexible customer segments. Insurtech integrates IoT as well to offer usage-based insurance solutions, such as lower premiums for a patron who remains physically active throughout the day.

Insurtech providers pave the way for humanoids – virtual manpower. These AI-powered assistants support customers through self-service portals. Leveraging NLP has enabled voice-triggered client engagement, query resolution and claim initiation. Bancassurance has set a new benchmark for hyper-interactive services that offer human-like experiences.

One of the newer insurtech-driven innovations incorporated within insurance solutions is blockchain-based smart contracts. Smart contracts instil transparency and accountability, which builds trust among customers and fraud resilience in insurance operations. Gamified applications, on the other hand, help improve insurance awareness and encourage healthier lifestyles by offering incentives through lower premiums or low-cost riders. They may utilise IoT devices for this purpose. Insurtech is the connecting medium to orchestrate the smooth integration of diverse technologies.

Challenges of Insurtech Integration

While the bancassurance model is beneficial for banks, its adoption poses certain challenges:

Banks operate on legacy technologies, which can be difficult to integrate with modern insurance technical infrastructures.

The insurance industry has stringent regulatory requirements, which may increase the governance overheads for banks.

Offering differentiated insurance products can be challenging in an environment of stiff competition from various industry players.

Training the banking staff on insurance processes requires overcoming change resistance and building tech confidence.

Insurtech providers accelerate banks’ transition to bancassurance. They also offer comprehensive solutions to automate complex tasks, ease employee transition with customisable and intuitive dashboards, and enhance compliance by integrating it within digital processes.

Unleash Unprecedented Growth with Insurtech

Bancassurance has dramatically enhanced sales volumes for insurance distribution via banks. In some developing countries, life insurance sales through bancassurance command higher than 50% of the market share!

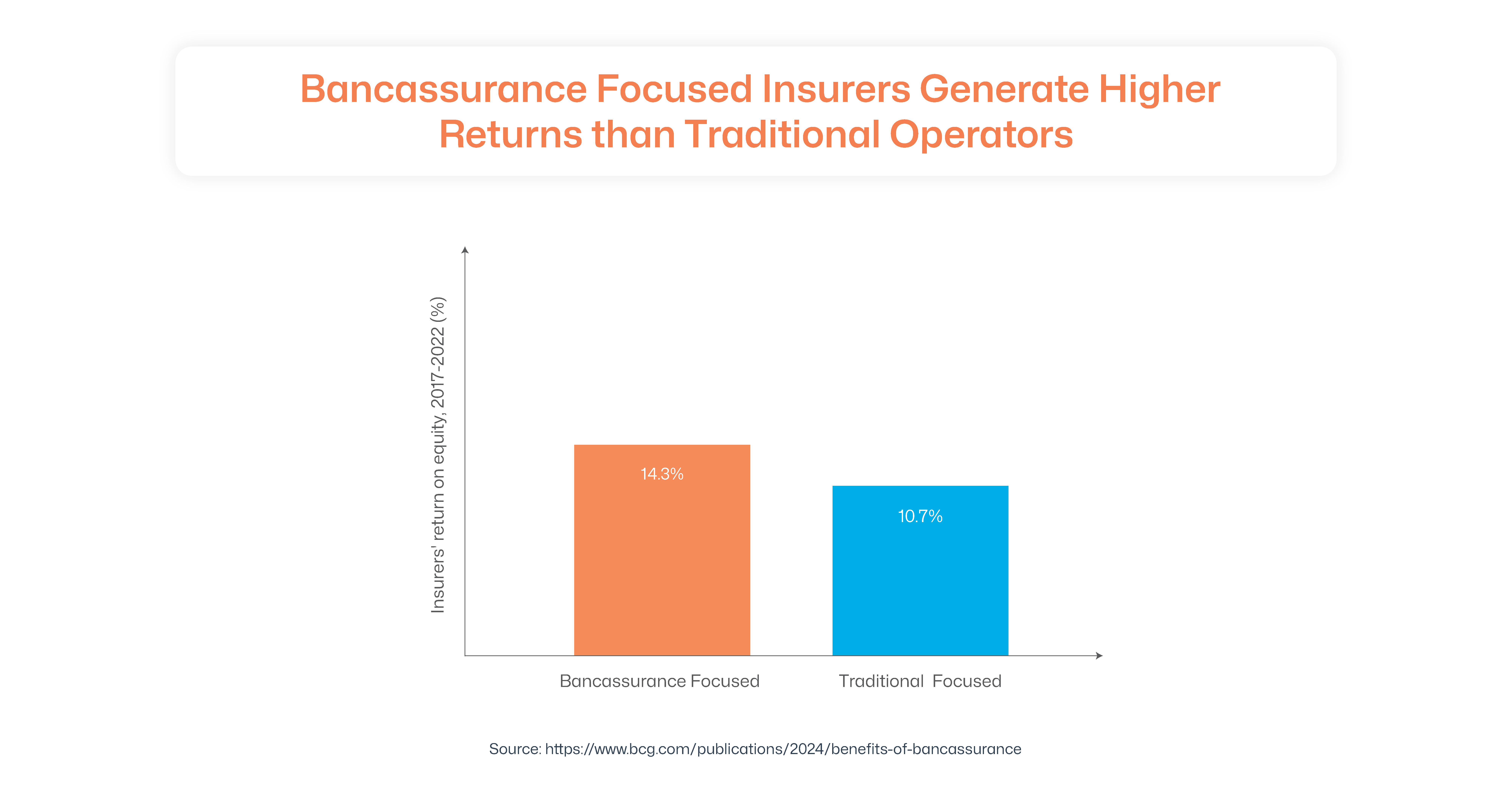

A joint analysis by Swiss Re Institute, Sigma Research and BCG found that the Bancassurance channel was more profitable for insurers than traditional policy distribution techniques. Notably, bancassurance is more profitable than insurance, which is significantly more profitable than banking.

There are over 250 crore bank accounts in India. Bancassurance enables banks to swiftly deliver greater value through a deep understanding of customer needs. Combined with the trust that banks enjoy, insurtech solutions can help unlock massive profit potential.

There are over 250 crore bank accounts in India. Bancassurance enables banks to swiftly deliver greater value through a deep understanding of customer needs. Combined with the trust that banks enjoy, insurtech solutions can help unlock massive profit potential.

Frequently Asked Questions (FAQ)

How does insurtech help banks offer personalised insurance products?

Insurtech brings data and tech together, helping banks understand customer behaviour, life stages, and financial habits better. With this insight, banks can offer the right insurance—at the right moment—whether it's travel coverage when you're booking a flight or health insurance after a major life event.

Can insurtech solutions help banks improve their fraud detection capabilities?

Modern insurtech platforms leverage real-time analytics, pattern recognition, and AI to identify anomalies. This allows banks to detect and respond to fraudulent activity with far greater speed and accuracy. Over time, these systems help banks reduce both risk exposure and operational costs.

How do mobile and digital channels enhance customer engagement in bancassurance?

Digital channels give customers control. For banks, this translates into more meaningful engagement. Features like instant quotes, automated reminders, and easy claims tracking not only improve the user experience but also deepen trust and long-term retention.